Tuscaloosa, AL: Alabama ONE recently announced 2 consecutive mergers with Brewton Mill Federal Credit Union (BMFCU) and McIntosh Chemical Federal Credit Union (MCFCU.) Both credit unions have been approved by their respective memberships and have been successfully merged into Alabama ONE’s operations.

Today, Alabama ONE Credit Union is pleased to announce that it has received regulatory approval to acquire the assets and deposits of the First Bank of Wadley, a wholly-owned subsidiary of Peoples Independent Bancshares, Inc. of Boaz, AL with total assets of $130 million. First Bank has a long, successful, and steady history serving individuals, businesses, and communities in Wadley, Roanoke, Hollis Crossroads, Goodwater, and Rockford, Alabama.

The First Bank transaction was unanimously approved by the Board of Directors of both institutions and is anticipated to close by the end of the year. This is Alabama ONE’s second bank acquisition – purchasing the First Bank of Linden in June 2021. The purchase of First Bank and its five branches increases Alabama ONE’s branch network to 25 branches statewide. As a result of this acquisition, Alabama ONE will extend its service, further establishing its footprint on the east side of Alabama, serving almost 4,000 additional members and businesses. In addition to this acquisition, which will expand Alabama ONE’s presence to Randolph, Coosa, and Cleburne counties with plans underway to open another branch in Wedowee, AL in 2024.

First Bank CEO Jared Kirby commented, “We are proud to lead Alabama ONE’s expansion into East Central Alabama. Our team is excited about its opportunity to introduce expanded products and services to the customers/members in the communities we serve.”

First Bank customers will have access to the latest online and mobile banking technology, affordable auto, mortgage, commercial, land and agriculture loans, rewards-driven credit cards, comprehensive insurance offerings, retirement and wealth advisory solutions, and financial wellness resources. Bill Wells, CEO of Alabama ONE commented, “We are looking forward to the completion of the First Bank acquisition and welcoming the First Bank Team members and customers to our Alabama ONE family. We are eager to deliver our full-service banking solutions to our newest members.”

Further Expansion of the Alabama ONE Footprint

With the First Bank acquisition, the merger of these two credit unions, addition of the Wedowee branch, and purchases of four additional former bank premises, Alabama ONE expects to increase its branch network to over 30 branches within the next 18 months. CFO, Whitney Oswalt said, “The strategic increase in our branch footprint along with our advanced technology platform further defines our commitment to rural Alabama.”

New Leadership Strategy Initiated to Support Growth

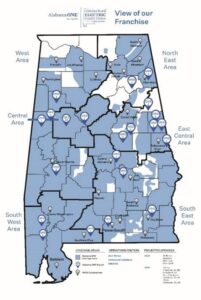

With these mergers, acquisitions, and upcoming additions on the horizon, Alabama ONE continues to expand to serve the rural markets of Alabama. To support the credit union’s growing strategy statewide, a new area management structure has been adopted. Wells stated, “The new area management structure will ensure Alabama ONE engages, empowers, and energizes our commitment and leadership within the local communities that we serve.” This new management structure includes West, East Central, Central, South East and South West Area Executives managing our Alabama ONE Team Members, service, and products within these areas.

Bill Rickman is Alabama ONE’s West Area Executive; Jacquie Johnson leads the Central Area; Jared Kirby, former CEO of First Bank, will become the East Central Area Executive; and Hal Hodge has recently joined Alabama ONE as the South East Area Executive. Aiming to elevate efficiencies and heighten the organization’s capabilities to achieve tailored business needs and opportunities native to their area, these Area Executives will report to Alabama ONE’s Chief Financial Officer, Whitney Oswalt, who leads the acquisition strategy for Alabama ONE.

With excellent member experience as a top priority, Alabama ONE continues to deliver on their commitment to Alabama Rural Electric Credit Union (ARECU) and the 23 rural electric cooperatives by providing more convenient access for members across the state. The credit union’s move into east Alabama further expands their reach and support of the rural elective cooperatives and their members.

About Alabama ONE

Alabama ONE Credit Union, based in Tuscaloosa, Alabama, was chartered in 1951 as the TRW Federal Credit Union. Today, Alabama ONE is a ONE billion-dollar plus, full-service financial institution that will have 26 branches by year-end 2023. Serving more than 87,000 Members across Alabama, Alabama ONE offers membership to persons or businesses (relatives and owners thereof) living, working, attending school, doing business, or receiving power from any of the 23 Alabama Rural Electric Cooperatives – a field of membership covering approximately 58 of 67 counties in Alabama. Alabama ONE provides a unique offering of consumer, business, agricultural, and mortgage related products, as well as wealth management and a full-service insurance agency. Alabama ONE is dedicated to giving members the resources they need to build the strong financial future they deserve.

###

Federally insured by NCUA. Equal Housing Opportunity. NMLS 401726. For more information, please visit www.alabamaone.org.

Leave a Reply