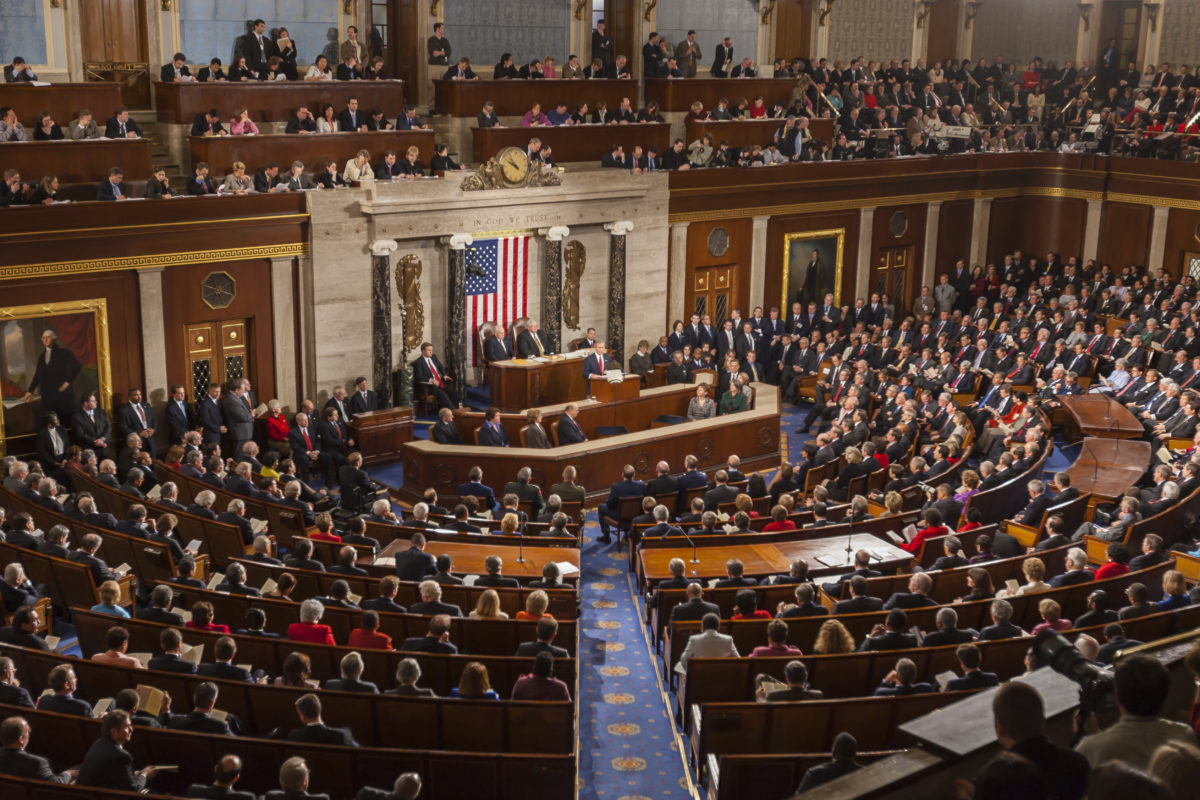

Credit unions’ special tax status appeared to be in the clear as both the Senate and House passed their tax reform bills recently.

The House passed its version of the bill in November. The Senate voted in favor of the Tax Cuts and Jobs Act early Saturday morning. Neither version of the bill proposes ending or changing the tax exempt status enjoyed by federally and state chartered credit unions.

“Both chambers of Congress have now passed tax reform bills without proposing any change to the credit union tax status, true evidence that both sides of the aisle recognize the

sound public policy and consumer benefit credit unions’ tax treatment brings to financial services,” said CUNA President Jim Nussle in a press release.

The credit union victory wasn’t without some lobbying. At first, the Senate bill included provisions that would have imposed a new Unrelated Business Income Tax requirement on credit unions and some trade associtiations that rep

resent them. The provisions would have required credit unions and trade associations to pay taxes on royalty income that credit unions depend on. Credit union opposition resulted in the elimination of UBIT from the bill.

The new tax bill hasn’t passed into law, yet. Both chambers of Congress are expected to meet in the coming weeks to resolve any differences between its two bills.

For more information on how the new tax bills could affect credit unions, visit CUNA’s Removing Barriers Blog.

Leave a Reply